Contents:

If you want to trade stocks and crypto, find a broker that offers a large selection and low fees. If you are new to trading stocks, apps like Robinhood and Webull offer built-in training and super-simple mobile apps to get started. But if you are looking to invest in retirement accounts, brokers like Acorns and Betterment help you automate the process and build a properly diversified portfolio without needing a finance degree.

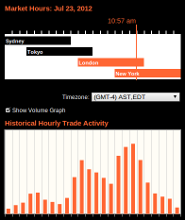

In our search for the best online broker for beginners, Forbes Advisor evaluated 21 brokers. In side-by-side comparisons, we assessed the user friendliness of each broker’s platforms, with a strong focus on the quality of educational and research materials. When you can trade will have quite an impact on which online broker you choose.

Learn more about commissions

Some brokerages have minimum deposit requirements while others offer a bonus just for opening an account. While a signup bonus may not make or break your decision to open an account, it’s worthwhile to know which platforms offer the best signup perks in the industry. Human and robo-advisor portfolio management services are also available, while stock ratings and real-time analytics help you make informed trading decisions. TradeStation is most well-known for its active trading features, and last year they even rolled out cryptocurrency trading. Their trading tools and ability to integrate with charting and automatic software make it a top choice for active traders.

US equity https://trading-market.org/s can be made for free, while trading options generate a commission of $0.65 per contract. Margin rates charged by this provider start at 8.95% for $10,000 or less, and are progressively reduced to 5.45% for account balances higher than $1 million. Options can be traded for $0.65 per contract, and futures can be traded for $1.5 per contract. The actual fees may vary depending on the instrument that is being traded. One of them, the SoFi Gig Economy ETF , tracks a basket of stocks in the so-called “gig economy” while the other — SoFi’s 50 — incorporates a selection of the 50 top stocks held by users within its platform. On the other hand, the firm doesn’t charge any other fees aside from these, as no additional expenses are incurred when depositing or withdrawing money from the account.

Equity best online stock broker for beginners, on the other hand, are usually a percentage of your total account value and charged annually. Some brokerages do not charge this fee, so you may be better off using them if you have a lot of money to invest. Educational brokerage accounts are similar in the sense that they get you a lot of tax breaks and help you make money faster. However, you will only be able to withdraw money from the account for verifiable educational expenses. Mainly, you need to decide whether you want to be an investor or a trader.

Ally Invest

Customer service is also readily accessible through a number of different channels, giving new investors peace of mind. Beginners will also find comfort with no balance requirements and low, transparent pricing. A similar protection exists for brokerage accounts through the Securities Investor Protection Corporation, or SIPC, a nonprofit membership organization that was created in 1970 by federal law.

Once you setup your portfolio, M1 helps you automatically re-balance when you deposit more money into your account. And when you sell, it also helps you re-balance by selling overweight items in your portfolio. M1 Finance is a relative new comer but they’ve been doing some amazing things with low cost investing and banking. These honorable mentions didn’t make the top 5, but they are really worth a look if you want someone else to do the work for you when it comes to investing and setting up your portfolio.

How to Set Up a Brokerage Account

Because all of these transactions are done online, you will have full access to your brokerage account and any advice you may need from their financial experts. When choosing a brokerage, investors should first decide which traits or services are most important to them. Some may value having robust research tools, whereas others want access to option trading. For beginning investors, criteria such as strong customer service and educational resources might be a high priority. Overall, newer traders should prioritize customer support and guidance, educational resources, and easy to use tools and platforms, so that you don’t become overwhelmed.

Web, mobile and desktop trading platforms are offered to suit all your trading needs. The fees, product offerings, and account minimums for each online brokerage are subject to fluctuation, which could impact how much you pay to open and maintain an account with each brokerage. Each of the brokerages on this list is a registered broker-dealer, backed by the Securities Investor Protection Corporation which protects customers if their brokerage firm fails.

This tool is accessible on the device of your choice, making it easy to have this learning resource at your fingertips. New product enhancements are continually rolled out as well, including updates to charting functionality and a portfolio digest feature announced in 2022. Robinhood introduced support for purchasing fractional shares and automatic dividend reinvestingin December 2019. Robinhood makes fractional share trading easy—when you go to place an order, you can elect to buy the stock by a number of shares or by a dollar amount.

We may, however, receive compensation from the issuers of some products mentioned in this article. This content has not been provided by, reviewed, approved or endorsed by any advertiser, unless otherwise noted below. Opinions are the author’s alone, and this content has not been provided by, reviewed, approved or endorsed by any advertiser.

- With an increasing number of online brokerages, it is extremely difficult for even the leading brokerages to differentiate themselves from the competition.

- Trading is not diffficult to learn if you invest enough time and energy into it.

- For new investors looking to enter the market, Robinhood provides the path of least resistance.

- And, for a limited time, traders can get up to $4,000 in cash when they open and fund a Firstrade Brokerage account.

- Domestic stocks funds give investors the ability to own stock in some of the world’s biggest companies through the world’s largest and most liquid market.

The minimum investment required to open an account with most online brokers is low. Public’s innovative approach is attempting to disrupt the way people trade stocks by introducing a low-cost operating structure that aims to crunch fees as much as possible for investors. Public only offers US-listed stocks and ETFs at the moment, and they support fractional shares. However, the firm does charge a $0.5 fee per contract for options and $1 per bond traded within the platform, with a minimum of $10 per trade. In addition, this broker’s zero-fee options trading service is particularly attractive for traders who prefer to operate with derivatives rather than buying the underlying asset directly.

Best Commission-Free Stock Brokers in Belgium (

The best trading platforms for beginners offer three essential benefits. First, the platform itself should be easy to use and beginner-friendly. Second is the availability of a wide variety of educational materials to get new investors off to a strong start. And third, the best platforms deliver access to quality stock market research. Online brokers specializing in beginner investing can make the sometimes-confusing stock market easier to master. You’ll want to look for a broker that offers a straightforward account process and makes it easy to buy and sell assets.

They are supposed to make trades on your behalf and are not allowed to use your money without your consent. Additionally, you also need to have human support to fix any problems that arise. Timing is everything when it comes to investing, and brokerages that are unable to solve your problems in a pinch will only hamper your progress as an investor. Most brokerages will allow you to add funds through PayPal and similar payment methods. However, for larger amounts, you will probably need to use a wire transfer or a direct deposit. Once the funds are in your account, you are free to invest them as you see fit.

Over the years, I have learned it is not just the trading tools that separate brokers, but the design, depth, speed, and overall execution of delivering the ultimate trading experience. This is where brokers such as TD Ameritrade’s thinkorswim and our honorable mention tastytrade really excel. Diehard fans exist for both, and either one is a great choice for seasoned traders. An online stockbroker should offer access to not only trading stocks, but also a strong selection of commission-free ETFs and the ability to analyze complex options positions. Other unique investment offerings to look for could include direct market routing, conditional orders, futures trading, and forex trading.

Firstrade stood out compared to the rest of the online brokerages on our list for its digital platforms, educational resources, and of course lack of fees for stock trades. Their desktop platform lets users build an account dashboard that lets them quickly view market activity, a snapshot of their account, information about current market movers, indices and news. And, for a limited time, traders can get up to $4,000 in cash when they open and fund a Firstrade Brokerage account.