Contents:

The chart consists of a black triangle and a red bullish line, forming the pole of the Pennant. If the price action tries to move below this point, you will automatically exit the trade. The breakout also confirmed the pattern and created a long opportunity on the chart. In case the price reaches the opposite side of the breakout, you should exit the trade immediately. This way, your trade will stay protected from unexpected price moves.

Forex Today: Stocks, US Dollar Firmer – DailyForex.com

Forex Today: Stocks, US Dollar Firmer.

Posted: Thu, 16 Feb 2023 08:00:00 GMT [source]

Like hammers, they offer an indication that a downtrend might be about to end with an impending reversal. For example, a red gravestone doji after a long uptrend may be a sign that a reversal is on the cards. Candlestick patterns are created by one or more individual sticks on a chart. Sign up for a demo account to hone your strategies in a risk-free environment. A keynote to add is that the FlagFlag’s bottom should not cross the Flagpole’s midpoint that forms after the pattern. Stop order is set at the level of the retracement top at the point .

Volume Breakout Indicator

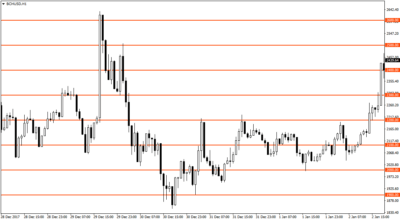

The image illustrates how you would perform your analysis to arrive at a potential trading opportunity. You will see the red Flag Pole and the blue Flag channel on the chart. To enter a Flag pattern trade, should first attain a confirmation signal. Next, we will develop some rules and guidelines for effectively trading with the Flag pattern.

Here, the flagpole is the price direction outside the pattern, while the actual flag is an area of consolidation. From there onwards, the pattern will breakout towards the previous trend, also called continuation. Typically, the flag portion of the bullish flag pattern doesn’t move perfectly horizontally. It frequently pulls back from the high point of the flag pole. If this is the case, buying a pullback can boost the trade’s potential profitability. A bull flag pattern is formed by a price rally with an increase in volume.

Forex and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 60.00% of retail investor accounts lose money when trading CFDs. Flags can be formed on tick charts in intraday trading, and even appear on weekly charts for swing traders.

Current Forex Rates

If it is, the market is unlikely to breakout with sufficient strength to make the trade worthwhile. This will save you from incurring a loss should the price action move below this level. See that we have also measured the size of the Flag as well as that of the Flag Pole.

The second target should be equal to the vertical size of the Pennant Pole. At the same time, you should not forget to set a stop loss order just below the lowest point of the Pennant. Just like with Flags, there are two types of Pennants, the bullish Pennant and the bearish Pennant.

It’s now time to discuss how you can come up with a winning trading strategy around this setup. From my experience, there are two times when you should trade the Flag pattern. Again, after seeing a Flag formation on your price chart, you will be able to measure the approximate price target on the formation. The Flag has a price action with evenly distributed tops and bottoms. Any trending move can transition into a flag, meaning that every trend impulse can appear to be a Flag pole. This shows that the trend is very strong in a bullish direction.

How to Trade Bearish and the Bullish Flag Patterns Like a Pro

At this point the market has finished consolidating and is now trending in the original direction. Using the distance we calculated above for the flag pole, we now have a measured objective for a possible target. The angle of this move is irrelevant in terms of the validity of the flag pattern.

That can be unintentional but it does happen and should be eliminated. In case a sudden price reversal happens, the trader’s profits won’t be wiped out of the account. The Flag pattern forms a channel correction, while the Pennant forms a triangle correction.

If not, it might be a better idea to skip the current pattern. What separates the flag from a typical breakout or breakdown is the pole formation representing almost a vertical and parabolic initial price move. These different types of flags can form after sharp declines or sharp rallies and they give hints about the future direction of the price movement. Certain types of price action must be present in the market, which need to be quantifiable to see a flag formation.

- To improve profitability we always average into the position and make use of support/resistance barriers.

- It can be applied to all the financial markets and not just the foreign exchange market.

- The angle of this move is irrelevant in terms of the validity of the flag pattern.

The flagpole, at both the beginning and the end of the flag, represents an impulsive momentum. The angle of this move doesn’t matter to the validity of the pattern. However, keep in mind that the main problem with trading flag patterns is a false breakout. The flagpole represents a sharp strong price movement, forming virtually a vertical line. The price move must be prominently larger and quicker than the recent price moves before it.

A https://forexbitcoin.info/ is a bullish chart pattern formed by two rallies separated by a brief consolidating retracement period. The flagpole forms on an almost vertical price spike as sellers get blindsided… In an ascending flag pattern, there’s another “pole” in opposite direction to the main trend, which forms a horizontal support line. The price action starts moving sideways and recording higher highs and lows . After that, we see a strong move towards the main trend direction and we call this a breakout.

cmc markets forex broker reviewting a stop-loss is critical to protect against downside risks. One common way to do this is closing the trade immediately, when the price moves above or below the opposite side of the breakout. Many traders place the stop loss at the extreme swing within the flag pattern. For instance, if it is a bullish flag, the stop-loss could be under the lowest bottom in the flag pattern.

Can a Bull Flag Breakdown?

One basic rule should be considered when determining the proper stop loss placement for this type of trade. If the price breaches the opposite side of the breakout, then you should immediately exit the trade, because the pattern is most likely false. The most logical location to place the stop loss would be beyond the most extreme swing within the Flag structure. So, if you were trading a bullish flag, then your stop should be placed below the lowest bottom in the Flag. Conversely, if you were trading a bearish Flag, then your stop should be placed above the highest top in the Flag. In this example, we also get to see a fake out that occurred out of the bearish pennant/symmetrical triangle.

However, there are times when traders create strategies around false breakouts as well. Combined with other indicators, flags can be useful technical tools for trend traders. Another way to set a profit target is based on the length of the flagpole.

The magenta and the purple arrows measure the size of the Flag and the size of the Pole. As you can see, these two sizes are applied on the chart starting from the breakout point. And as each target is hit, the stop loss order should be adjusted accordingly as shown on the image above.

The two sizes have been applied to the chart right from the breakout point. Locking in profits will save you from a situation where your profits are wiped out of your account when a price reversal occurs. With every target, the stop loss order should be moved upwards.

You could interpret a flag pattern as a brief pause in the middle of a sustained trend. The lack of volume signals that the retracement doesn’t have the same strength as the initial move, making it more likely that the trend will take over again. The price retracement within the flag offers an opportunity to buy or sell the market at a better price than if the trend is still going strong. This is shown with the purple and the magenta arrows on the chart.

All information on The Forex Geek website is for educational purposes only and is not intended to provide financial advice. Any statements about profits or income, expressed or implied, do not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. Self-confessed Forex Geek spending my days researching and testing everything forex related. I have many years of experience in the forex industry having reviewed thousands of forex robots, brokers, strategies, courses and more. I share my knowledge with you for free to help you learn more about the crazy world of forex trading!

Traders expect the stock to keep falling so they keep selling it leading to further price falls. However, instead of continuing lower, the price forms a flag, then gradually starts rising again. These flags are very common in all financial markets; stocks, indices, and Forex pairs. The example above shows an ascending flag pattern with multiple pull-backs.