Contents:

Falling wedges form at the bottom of a downtrend whereas rising wedges form at the top of an uptrend. Directional wedges inform about the struggle between bulls and bears when the market is consolidating. For instance, a rising wedge in a downtrend is an indication that buyers are actively pushing the price higher, but they are forming higher lows faster than they are forming higher highs. This is a signal of buyer exhaustion and prices are likely to break lower to resume the downtrend.

The pattern is considered a continuation pattern, with the breakout from the pattern typically occurring in the direction of the overall trend. Using chart patterns to trade the Forex market isn’t for everyone. However, if you enjoy using raw price action to identify opportunities, the three formations above would make a great addition to your trading plan. There are three key chart patterns used by technical analysis experts.

Three Crows pattern (Three Buddhas)

All three https://traderoom.info/ should fall to the same support level – known as the neckline – and while the first two will rebound, the final attempt should break out into a downtrend. Pennants can be either bullish or bearish, and they can represent a continuation or a reversal. In this respect, pennants can be a form of bilateral pattern because they show either continuations or reversals. Pennant patterns, or flags, are created after an asset experiences a period of upward movement, followed by a consolidation.

A topping pattern is a price high, followed by retracement, a higher price high, retracement and then a lower low. The bottoming pattern is a low (the “shoulder”), a retracement followed by a lower low (the “head”) and a retracement then a higher low (the second “shoulder”) . The pattern is complete when the trendline (“neckline”), which connects the two highs or two lows of the formation, is broken. With so many ways to trade currencies, picking common methods can save time, money and effort.

- But they’re still important to know if you’re interested in identifying and trading trends.

- And when you are setting your stop loss, again, give it some room for a trade to breathe.

- To figure it out, divide hypothetically the entire expected rising wedge pattern into three equal intervals; you’ll need the interval, where the support and resistance levels have met.

- While they provide compelling trade signals, it is important to exercise strict risk management when trading chart patterns because they are not 100% reliable.

In this article, we discuss the top 15 chart patterns that every Forex trader should know. During a healthy and strong downtrend, the price will stay away from the Moving Average. If the price then reaches back to the Moving Average it can signal the next correction or even a reversal, depending on the overall situation and present chart pattern. The final chart situation shows that after the first successful triangle breakout, the market formed a second chart pattern shortly after. The second triangle is much narrower in height which is a strong bullish indicator as well since there seem to be very few sellers and still a lot of buyers, buying the dips.

Unlike ascending triangles, the descending triangle represents a bearish market downtrend. The support line is horizontal, and the resistance line is descending, signifying the possibility of a downward breakout. The ascending triangle is a bullish ‘continuation’ chart pattern that signifies a breakout is likely where the triangle lines converge. To draw this pattern, you need to place a horizontal line on the resistance points and draw an ascending line along the support points. What’s more, other helpful chart patterns are more complicated to spot. For instance, remembering the formations and ratios of harmonic chart patterns, like the harmonic crab pattern, can be pretty complex, so a cheat sheet can be helpful.

Chart patterns

You should only trade in these products if you fully understand the risks involved and can afford to incur losses that will not adversely affect your lifestyle. As the name suggests, the pattern consists of three peaks that are equally high. It first seemed as if the price was ready to reverse higher when the price made a higher high from the left shoulder to the head.

While patterns are not as easy to pick out in the actual Ichimoku drawing, when we combine the Ichimoku cloud with price action we see a pattern of common occurrences. The Ichimoku cloud is former support and resistance levels combined to create a dynamic support and resistance area. Simply put, if price action is above the cloud it is bullish and the cloud acts as support. If price action is below the cloud, it is bearish and the cloud acts as resistance. Candlestick charts provide more information than line, OHLC or area charts.

Dow Jones technical analysis: If this bear flag gets busted, bulls could party. – ForexLive

Dow Jones technical analysis: If this bear flag gets busted, bulls could party..

Posted: Mon, 13 Feb 2023 08:00:00 GMT [source]

Find out which account type suits your trading style and create account in under 5 minutes. In the screenshot below the price broke out with a high momentum candle. This movement is usually 78.6% of XA and completes the Gartley pattern. The foreign exchange market – also known as forex or FX – is the world’s most traded market.

Flag Pattern

The forex chart patterns and falling wedges chart pattern indicates market breakouts. They consist of a price range that becomes too narrow and results in a final breakout that marks a trend reversal. Once you have that mastered it becomes far easier to trade forex patterns. As you identify a pattern developing you highlight the proper buy point and if the price of the currency pair hits that point you enter your position. You should also have a profit target where you exit the position to collect profits.

One of the most popular neutral pattern charts is the Symmetrical Triangle. In Neutral chart patterns, the market may break either up or down. Catching the market after the confirmation of breakout gives you more profits with small risk. It is an easy trading skill if you practice more with different market charts. Become Professional trader using the below technical chart patterns.

A reasonable stop loss can be set around the level as high as the local high, preceding the neckline breakout in order to regulate the potential risks involved in the trading. You can open a buy position when the price, having broken through the resistance levels of the formation, reaches or exceeds the local high, preceding the resistance breakout . The target profit is marked at a distance that is equal to the height of the pattern’s either bottom, or shorter.

The pattern is often identified long before the second channel is completed, so you can trade inside the channel. As a rule, the final entry candlestick must be much longer than the three preceding candles and engulf them. The formation is a rather rare proprietary pattern, but it often works out successfully. The pattern looks like Three Crows pattern, I’ve already described, but inverted.

Bullish rectangle chart pattern

However, regardless of whether it was caused by some unknown news event or not, the volume indicator can yet again be used to help trade the pattern. The chart image above shows a clearly defined range in the EUR/USD before an important interest rate decision. This specific news event led to a strong breakout to the upside, which offered a great scalping opportunity. 7) Chart patterns are not clear to draw using the candle charts when comparing to the line chart. Wait for a breakout of the Triangle pattern to enter into the trade. If you saw a Triple bottom in the chart, wait for the confirmation of breakout at the recent high level.

- After a brief decline, a morning star candlestick pattern formed, which signalled that price was getting ready to potentially move higher again.

- When a rectangle forms, traders look to place a trade in the direction of the dominant trend when the price breaks out of the range.

- Although the triple top is a straightforward chart pattern, I wanted to include some additional chart pattern trading tips with this example.

- But more than that, it can be quite easy to spot and extremely profitable when you know what to look for and how to trade it.

Combine that with a precise entry and a well-placed stop loss that is 50 to 100 pips away, and you have a recipe for a profit potential of 3R or better just about every time. Like the head and shoulders, flags often form after an extended move up or down and represent a period of consolidation. It’s essentially an indecision point in the market, where the bulls and bears are battling to see who will win control. However, by adding “bull” or “bear” to the designation, we’re giving it a directional bias. So as you might expect, it is most often traded as a continuation pattern. Wedges tend to play out relatively quickly compared to something like the head and shoulders pattern.

Expanding Triangle

Price action trading is one of the most successful trading strategies in fx trading. A rectangle chart pattern is a continuation pattern that forms when the price is bound by parallel support and resistance levels during a strong trend. The pattern denotes price consolidation, with drivers of the dominant trend needing to literally ‘catch a breath’ before pushing further.

The price may bounce off one of the trend lines and reverse the trend altogether. Taking this into consideration, it’s obvious that the safest course of action while trading these patterns is to wait for a breakout and go with whatever direction the price moves next. Symmetrical triangles occur when the price starts moving up and down within a limited range that gets smaller and smaller over time.

6) There are more advantages when comparing to the dis-advantages of chart patterns. Trade forex chart pattern carefully as per the strategy on “How to trade chart patterns? 5) Beware of fake breakouts while trading the chart patterns, don’t take any breakout trade unless the breakout is confirmed. Want to know, how to confirm the breakout or avoid fake breakout in trading? If the market reaches the bottom support of the Triangle line, you can place buy trade.

Not only does this help you decide where to place your take profit order, but it also enables you to calculate your risk-reward ratio for the opportunity. Some patterns are more suited to a volatile market, while others are less so. Some patterns are best used in a bullish market, and others are best used when a market is bearish. Target profit is sometimes set at the level of the trend beginning just ahead the scheme itself.

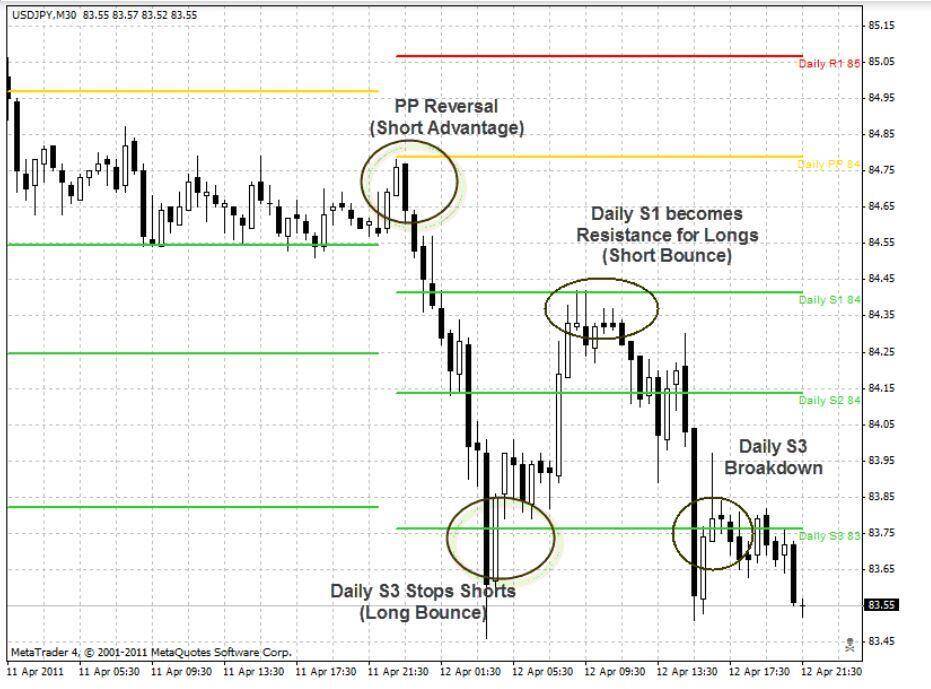

If the breakout happened in the trend direction, Then we can confirm it as Corrective Wedge. Corrective Wedge pattern is a correction that happened during the trend which forms a Wedge Shape in the Chart. Access our latest analysis and market news and stay ahead of the markets when it comes to trading. However, the distance between the two higher highs is very short and already indicates weakness in the trend. During a trending phase, the price will generally stay below the Moving Average without touching it. During a corrective phase, the price will start trading around such a Moving Average or back into a central Pivot.

How to Trade Reversals in Forex – DailyForex.com

How to Trade Reversals in Forex.

Posted: Mon, 06 Feb 2023 08:00:00 GMT [source]

In our bull flag, for instance, you might set your stop loss close to the pattern’s support line. Even if you’re sure that a trend is about to take off, you’ll want to set a stop loss as you enter your position. It closes your position automatically if it moves against you by a set number of points, helping to ensure that you don’t lose too much.

Crude Oil: Will “Banking Crisis Send Prices Even Lower”? Ha! – Action Forex

Crude Oil: Will “Banking Crisis Send Prices Even Lower”? Ha!.

Posted: Fri, 31 Mar 2023 07:00:00 GMT [source]

It is, therefore, important that traders only take advantage of opportunities whose risk/reward ratios are compelling enough. Similarly, triple tops and triple bottoms form after the price makes three peaks or valleys after a strong trending move. They also signal fading momentum of the dominant trend and a desire for the market to change course. The height of the formation also serves as the price target for a reversal when the neckline is breached. Double tops and double bottoms form after the price makes two peaks or valleys after a strong trending move. They signal price exhaustion and a desire by the market to reverse the current trend.

Entries could be taken when the price moves back below the cloud confirming the downtrend is still in play and the retracement has completed. The cloud can also be used a trailing stop, with the outer bound always acting as the stop. Find the approximate amount of currency units to buy or sell so you can control your maximum risk per position. The illustration below shows price action that you would want to ignore completely. For those who have followed me for a while now, you may recall that my favorite pattern to trade used to be the wedge. I’ve often said that you only need one pattern to become successful as a Forex trader.

Well, if the market trades above the highs, you can expect that this cluster of stop-loss would become buy orders. Where the market breaks above a significant high and then does a sudden reversal, closing lower. And then suddenly the market does 180-degree reversal and smashes lower and close near the lows of the candle. BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following.